How Critical Illness and Hospital Indemnity Insurance Can Help

Severe illnesses typically have high treatment costs. Critical Illness insurance pays benefits for serious illnesses and can be a financial lifeline at times when you need it most. Hospital Indemnity insurance also provides valuable benefits. Layering these plans can be an effective way to maximize your payout for covered conditions.

Supplemental Health Insurance to Help Bridge Coverage Gaps

Explore Accident, Critical Illness, and Hospital Indemnity plans.

Sarah had always been active and healthy, but when crushing abdominal pain sent her to the ER, the last thing she expected was a cancer diagnosis. Fortunately, she had purchased both Critical Illness and Hospital Indemnity insurance to supplement her high-deductible health insurance plan. Here’s how those benefits helped:

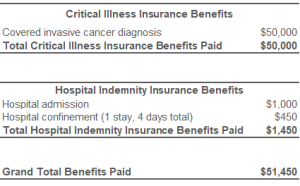

Following treatment, Sarah was cancer-free for over a year, during which time she continued to receive annual scans. But 15 months later, doctors discovered a new tumor. Because Sarah had been cancer-free for over 12 months, she was able to file new Critical Illness and Hospital Indemnity claims.1 Benefits were again paid to Sarah:

Cash benefits totaling $104,150 for her two cancer diagnoses and resulting hospitalizations were paid directly to Sarah at times when she truly needed help with both her medical and non-medical expenses.

Click here to explore Critical Illness insurance.

Click here to explore Hospital Indemnity insurance.

Learn more about National Cancer Institute-Designated Cancer Centers.

1 A critical illness or hospitalization is not covered if it is caused by or results from a pre-existing condition within in the last 12 months or within the first 12 months of coverage. Because Sarah had been cancer-free for over 12 months, her first diagnosis was not considered a pre-existing condition, so she was able to file a new claim for the recurrence. Critical illness benefits are subject to a lifetime maximum of 300% of the amount of insurance purchased. Hospital admission benefits are payable to a maximum of five times per calendar year; hospital confinement benefits are payable to a maximum of three times per year.

Group Accident, Hospital Indemnity and Group Critical Illness Insurance coverages are limited benefit policies issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. Prudential’s Group Accident, Hospital Indemnity and Group Critical Illness Insurance coverages are not substitutes for medical coverage that provides benefits for medical treatment, including hospital, surgical and medical expenses, and they do not provide reimbursement for such expenses. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. If there is a discrepancy between this document and the Booklet-Certificate/Group Contract issued by The Prudential Insurance Company of America, the Group Contract will govern. A more detailed description of the benefits, limitations, and exclusions applicable are contained in the Outline of Coverage provided at time of enrollment. Please contact Prudential for more information. Contract provisions may vary by state. Contract Series: 83500 and 114774.

This coverage is not health insurance coverage (often referred to as “Major Medical Coverage”).

THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

1076221-00001-00